Description

Client's General Questions

Yes, it is mandatory to file NIL Return in case of no transaction in your business. Otherwise govt will charge late fees for not filing or can take some action against your GST Registration.

This GST Return Filing Service includes GSTR1 & GSTR3B filing.

Documents list:

- All Sale Invoices

- All Purchase Invoices

- All Expense Invoices

- All Import & Export Documents

You can scan the documents or click the photo of documents & send us through mail or whatsApp.

- After receiving payment, a GST expert will mail & call you to provide documents.

- Then, he will transfer all documents to GST filing team.

- After return is prepared, he will call you to discuss about tax payments.

- After filing is complete, he will mail you GST filing acknowledgement.

- Next month, he will remind you by mail & call to file your GST Return.

- You can ask any query to him for any confusion during or after filing process.

12 months filing plan is best for you as it will cost you ₹350/month & saves ₹1800.

It takes 1-2 days to file 1 month GST Return.

GST Returns are filed on monthly basis. So, you have to file your GST Returns every month .

By referring us 2 clients for GST Return Filing, you can get this service for free.

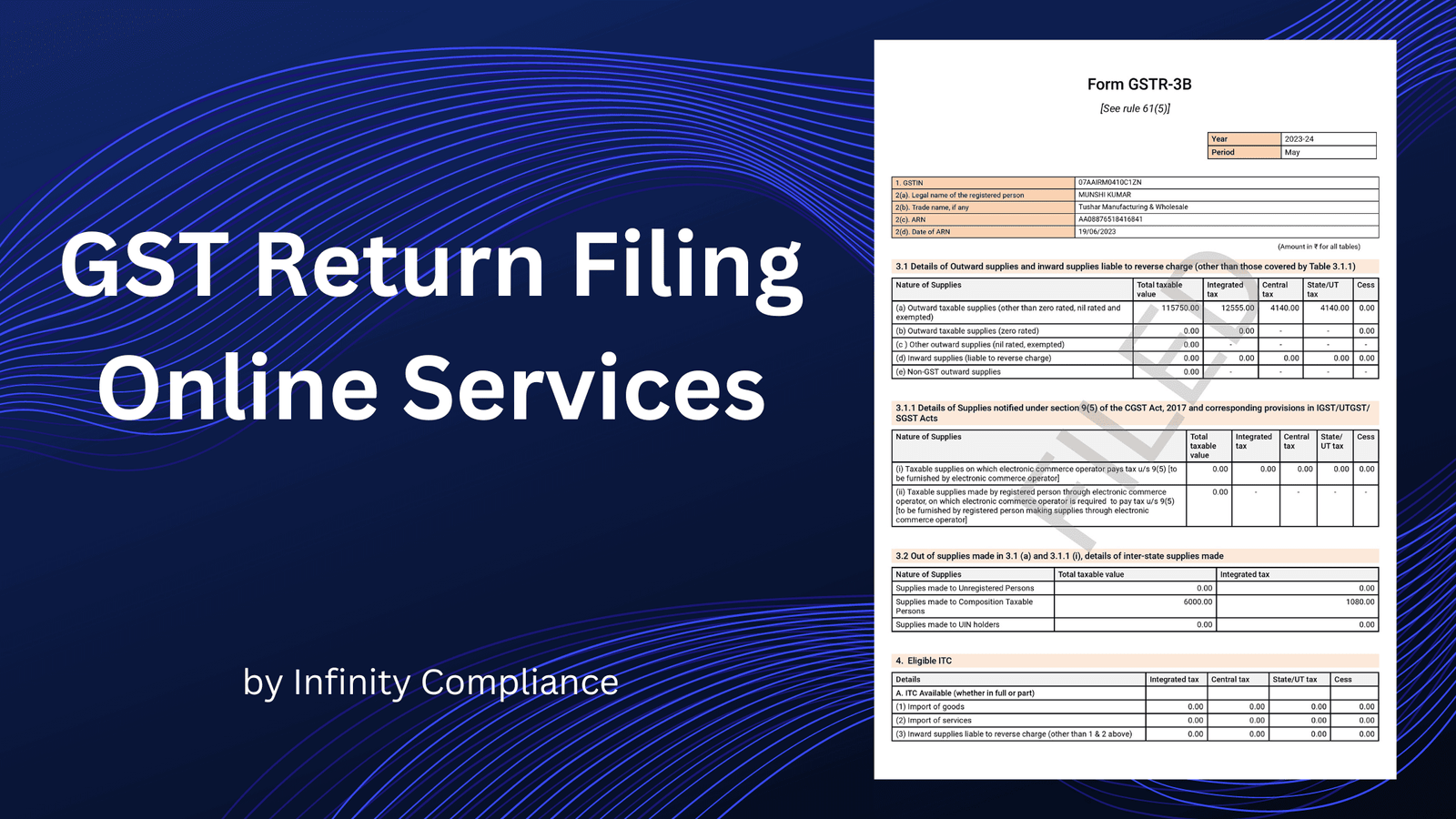

What is GST Return Filing?

GST return filing is done to maintain financial accounts per year. GST return is a document that contains the details of the income of the taxpayer. This document needs to be filed with the tax authorities.

GST return filing in India is mandatory for all the entities that have a valid GST registration irrespective of the business activity or the sales or the profitability during the period of filing the returns. Hence, even a dormant business that has a valid GST registration must file the GST returns.

GST return is a document that contains the details of all the income or the expenses that a taxpayer is required to file with the tax administrative authorities.

Contact Us

Why Choose Us ?

Timely Submission – We will submit your GST returns within a period of 3 days from the date of submission of all details. There is also no chance of penalties in future.

Year Around Expert Consultation – Get consultation for GST on call. There is no limit on the number of questions or time limit.

Save Money (100% ITC Guaranteed) – We offer trusted and professional at affordable prices when compared to market standards.

In-House Team of Professionals – We have our professional in-house team. We do not sub-let your work to others.

GST Returns filing benefits

Claim Input Tax Credit – When you file your GST return, you can claim Input Tax Credit (ITC) on the GST paid on purchases. ITC is the tax paid on inputs used to make the final product or service, and it can be claimed as a credit against the tax payable on the output.

Track Business Performance – By filing GST returns, you can track your business performance, as the returns provide a summary of all the sales and purchases made during a specific period.

Facilitate Business Expansion – Filing GST returns can facilitate the expansion of your business. As GST returns provide a record of all transactions, it can be used as a basis for making strategic decisions about future investments and expansion plans.

Transparency – GST returns are a transparent way of reporting your business transactions. This helps in preventing any possible errors or discrepancies in reporting your business transactions.

About This Plan

Filing GSTR 1, 3B returns for your business is now super easy! Opt for any plan and get all filing and compliance needs taken care of!

Services Covered :-

- GSTR1 Return Filing

- GSTR3B Return Filing

- Filing for B2B and B2C invoices

- Valid for businesses with turnover less than 1.5 crores

How It's Done

- Add service to cart

- Proceed to checkout

- Fill the information & purchase the plan

- A relationship manager will be assigned to you.

- He will mail & call you to provide documents.

- Then he will transfer your documents to GST experts team for filing.

- After filing, he will mail you acknowledgement.

- Next month, he will remind you for GST Filing by mail & call.

TYPES OF GST RETURNS

| Returns | Particulars | Frequency | Date |

|---|---|---|---|

| GSTR1 | Details of outward supplies of goods and services | Monthly | 11th of the next month |

| GSTR2B | Details of inward supplies of goods and services affected | Monthly | 13th of the next month |

| GSTR3 | Monthly return, in the case of finalization of details of outward supplies and inward supplies along with the payment of tax. | Monthly | |

| GSTR3B | It is a simple return in which the summary of outward supplies along with Input Tax Credit is declared and payment of tax is affected by the taxpayer. | Monthly | 20th of the next month |

| GSTR4 | For all the taxable person registered under the composition levy | Quarterly | 18th of the next month after the quarter |

| GSTR5 | Returns for a non-resident foreign taxable person | Monthly | 20th of the next month |

| GSTR6 | Returns for an input service distributor | Monthly | 13th of the next month |

| GSTR7 | Returns for authorities deducting TDS | Monthly | 10th of the next month |

| GSTR8 | Details of supplies effected through the e-commerce operator and the amount of tax collected | Monthly | 10th of the next month |

| GSTR9 | Annual return for a normal taxpayer | Annually | 30th December of the next financial year |

| GSTR9A | The annual return of a taxpayer registered under the composition levy anytime during the year | Annually | 31st December of the next financial year |

| GSTR9C | It is mandatory for registered taxpayers with a total turnover exceeding ₹5 Cr for the relevant financial year to file the GSTR 9C reconciliation statement. GSTR 9C must be prepared and self-certified by the taxpayer on the GST portal | Annually | 31st December of the next financial year |

| GSTR10 | Final return | Only once, when GST registration is canceled or surrendered | Within 3 months of the date of cancellation or the date of cancellation of the order, whichever is later |

| GSTR11 | Details of inward supplies to be furnished by a person having UIN and claiming a refund | Monthly | 28th of the following month for which the statement is filed |

Client Reviews

Business Registrations

Difference Type

- Recommended For

- Ease of Investment

- Limited Liability Protection

- Tax Advantages

- Perpetual Existence

- Statutory Compliances

Limited Liability Partnership

- Professional Service Firms

- Possible, but unlikely

- Yes

- Most efficient

- Yes

- Low

Private Limited Company

- Start-Ups & Growing Businesses

- Very Easy to Accommodate

- Yes

- Few Benefits

- Yes

- High

Reviews

There are no reviews yet.