CGST, SGST, IGST

What is CGST, SGST & IGST?

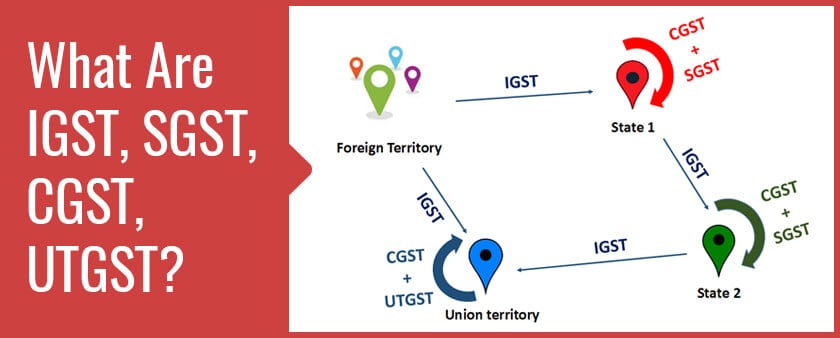

IGST, CGST, and SGST are categories of GST that are charged by Central and State Governments on the basis of supply and consumption. The Goods and Services Tax (GST) is a multi-staged and destination-based indirect tax, charged on the supply of goods and services. GST is multi-staged; thus, it is charged at every level of the stage of production, and being destination-based, the tax is collected from the ultimate point of consumption and not from any point of origin. Based on these features, the GST is divided into three sub-taxes, which are Integrated Goods and Services Tax (IGST), Central Goods and Services Tax (CGST), and State Goods and Services Tax (SGST).

The government will collect CGST, SGST, or IGST depending on whether the transaction is Intra-State or Inter-State. When the supply of goods or services happens within a state called as intra-state transactions, then both the CGST and SGST will be collected. Whereas if the supply of goods or services happens between the states called as inter-state transactions and IGST will be collected.

It is to be noted that the GST is a destination-based tax, which is received by a State in which the goods are consumed but not by a state in which such goods are manufactured.

Unlike earlier when there were multiple taxes such as Central Excise, Service Tax and State VAT etc., under GST, there is just one tax.

IGST, CGST & SGST Full Form

GST Category | Full-Form |

|---|---|

| IGST | Integrated Goods and Services Tax |

| CGST | Central Goods and Services Tax |

| SGST | State Goods and Services Tax |

- IGST, CGST, and SGST are categories of Goods and Service Tax.

- IGST applies to interstate transactions and CGST and SGST to intrastate transactions.

- IGST is collected together and distributed to the Central and State Governments.

- SGST and CGST are collected directly by the Central and State Governments

What is Integrated Goods and Services Tax (IGST)?

IGST is levied on all interstate supply of goods and services by the Central Government. Unlike, CGST, SGST, & UTGST which are levied upon the supply of goods or services within a state.

IGST has provided a standardization to taxation on the supply of goods and services made outside the state. This applies both on a supply made outside the state and those made outside the country.

The rate of IGST would always be approximately equal to the CGST rate plus SGST rate.

– Example of IGST

Asim from Haryana sold goods to Pankaj from Rajasthan, amounting to ₹ 1,00,000. If the GST charged is 12%, then this 12% is IGST. Instead of two, only one tax is charged that is handed over to the Central Government, out of which 6% is credited to the state of consumption. Thus, IGST compromises both CGST-tax to the Central and SGST-tax to the state. IGST is different because instead of direct distribution of the tax to the Centre and to state, the tax is collected in an ‘integrated’ manner and distributed later.

What is Central Goods and Services Tax (CGST)?

Central Goods and Services Tax or CGST is the indirect tax levied by the Central Government. It is levied on the transaction of goods and services which are undertaken within the state i.e. intrastate. The tax collected under the head “CGST” is payable to the central government treasury.

The CGST is charged to compensate the central government for previously existed indirect taxes such as

- Central Excise Duty,

- Service Tax,

- Duties of Custom,

- Surcharges,

- Cesses, etc.

The CGST is charged along with SGST or UTGST and at the same rates. This is done as per the Dual GST model followed in India, where both central and state governments have their separate taxation legislatures.

What is State Goods and Services Tax (SGST)?

State Goods and Services Tax or SGST represents the tax imposed by the State Government. SGST is levied on the transaction of intrastate sales of goods and services, i.e. sales made within a state.

SGST is charged along with and at the equal rates that of CGST on a good or service. This tax is charged by all the states of India but has also been adopted by two union territories of

- Puducherry and

- Delhi,

because both of these union territories have their own legislative assembly and council.

The tax revenue under SGST goes to the State Government treasury or the eligible Union Territory, where the consumption of goods or services has taken place.

– Example of CGST and SGST

Ramesh from Punjab sells goods to Manoj living in the same state worth ₹ 1,00,000. If the applicable intrastate GST on this transaction is 12%, then 6% is directly charged as CGST and another 6% as SGST. Thus, instead of an integrated tax, the tax is collected separately for the two hierarchical authorities, and there is a direct-distribution of tax, instead of indirect taxation.

Difference between CGST and SGST in tabular form

Central GST & State GST are components of GST, Goods and Service Tax.

Parameter | CGST | SGST |

| Expansion | CGST expands as Central Goods and Service Tax. | The expansion of SGST is State Goods and Service Tax. |

| What are the taxes that are subsumed? | Different indirect taxes of Central Excise Duty, Central Sales Tax CST, Service Tax, Additional excise duties, excise duty, CVD (Additional Customs duty – Countervailing Duty), SAD (Special Additional Duty of customs) surcharges and cesses are merged with CGST. | In SGST, the taxes like State Sales Tax, VAT, Luxury Tax, Entertainment tax (unless it is levied by the local bodies), Taxes on lottery, betting and gambling, Entry tax, State Cesses and Surcharges in so far as they relate to supply of goods and services, etc. are subsumed. |

| Share of tax revenues | The share of tax revenue under CGST is meant for central government. | The share of tax revenue under SGST is meant for state government. |

| Mechanism for usage of credits | A dealer can use input tax credit of CGST against CGST or IGST. The credit of CGST cannot be used against SGST | A dealer can use input tax credit of SGST against SGST or IGST. The credit of SGST cannot be used against CGST |

This is the “CGST, SGST, IGST” list.

You can always follow us on Facebook to get notified of new blogs like this, by clicking here. Follow Us Now !!!

Thanks for visiting our blog. (CGST, SGST, IGST)

HAVE A GOOD DAY.

Compliance Service for Private Limited Company